Official Guaranteed Issue rules.

Based on reports from HP Alumni Association members who have completed enrollment. Join forums:

https://www.hpalumni.org

Not officially endorsed or supported. Question? Email us:

info@hpalumni.org

(Page updated Dec 20, 2025)

If losing your health plan

(because HPInc or HPE dropped your group plan -- or because

your current insurer in no longer offering plans in your county)

you may be able to buy a Medigap plan under the "guaranteed issue" rules.

"If you have a guaranteed issue right, an insurer: Must sell you

a Medigap policy. Must cover all your pre-existing health

conditions. Can't charge you more for a Medigap policy because

of past or present health problems." --Medicare

Buy your new policy before Dec 31 to avoid having a gap in

coverage. If you join a new plan after

Dec 31, coverage in the new plan won't start until the month after you join

-- as stated in the cancellation notice from your current

insurer. Depending on your financial

and health situation, your preference for your current doctors and

medical system, and your personal tolerance for risk, you may want

take advantage of this one-time opportunity to move from your current

HPInc or HPE Advantage-level coverage to a more flexible Medigap plan --

without the normally-required evaluation of your current health.

(Summary of the Advantage vs Medigap decision:

https://www.hpalumni.org/enroll-advantage-medigap ) If an insurance sales agent (or an online policy application) insists on you answering

detailed health questions -- beyond "Are you disabled?" and "Do you use

tobacco?" -- you are undergoing medical underwriting. Stop the

application process immediately and insist on your guaranteed issue

right! Either the wrong box was

checked somewhere in the enrollment process -- or there is a system

problem. Needless to say, some

insurers make it difficult for you to exercise your guaranteed issue

rights. Note that the insurance

sales agent is filling in an online form provided by the insurer. Several members report that

their licensed AlightRHS agent did not understand this very complex

topic. If so, insist on speaking to a supervisor. (One member was asked by

the agent for their height and weight -- and answered. That application

is still stuck in "medical underwriting" limbo at the insurer. Based on

an escalation by HPAA, an AlightRHS expert is working on it.)

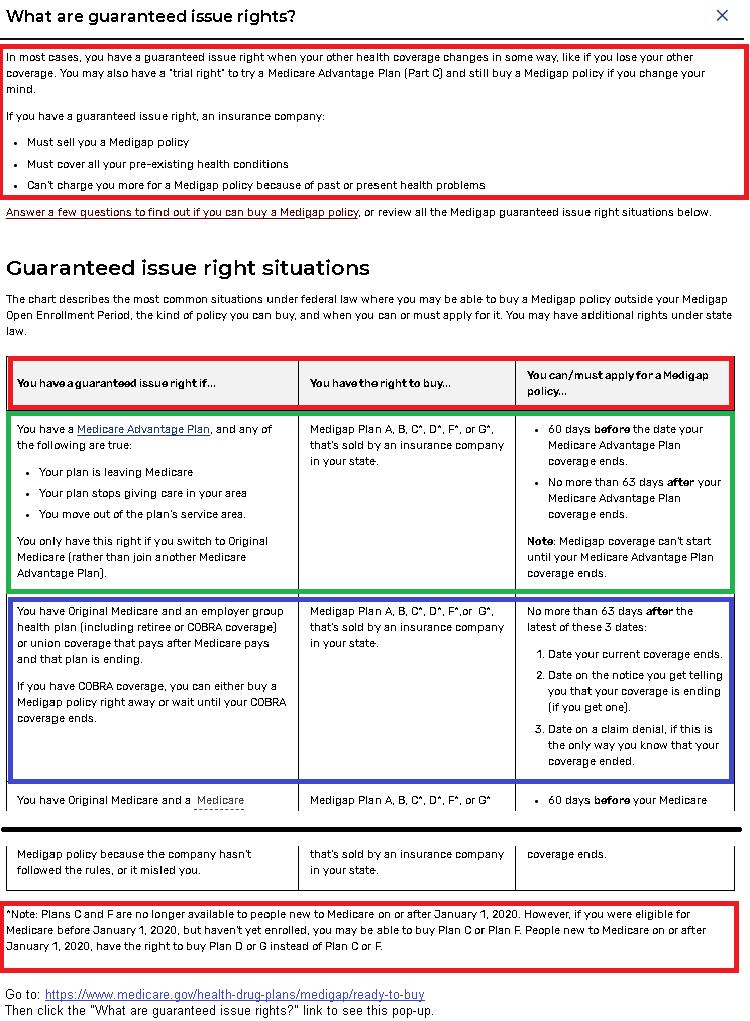

To see the official Medicare guaranteed issue rules, go to:

https://www.medicare.gov/health-drug-plans/medigap/ready-to-buy

Then click the "What are guaranteed issue rights?"

link to see the pop-up.

Here's a screenshot from

the official Medicare site -- with relevant items highlighted:

https://www.hpalumni.org/Medicare-GuaranteedIssue2.png

The first row in the chart -- outlined in green in our screenshot -- applies if your current insurer is no longer offering plans in your county.

The second row in the chart -- outlined in blue in our screenshot -- applies if you have an HPInc group Medicare plan that is ending.

Note the wording in the chart: "You have the right to buy... Medigap Plan A, B, C*, D*, F*,or G*, thatís sold by an insurer in your state."

To verify what an insurance sales agent (at AlightRHS or elsewhere) is saying about Medigap plans available to you, use the Plan Finder on the official Medicare site to see all Medigap plans available in your state.

https://www.medicare.gov/plan-compare Enter your ZIP code. Select "Medigap policy" and click "Find Plans."

For any plan letter you are interested in (A through N), click "View Policies" to see all insurers who offer that plan letter in your state.

(Notes: Some are small local or regional plans. The plan names indicate that some are for veterans or other specific groups. Some plans only sell direct or through a single agency.)

Not all policies are available from AlightRHS. As with any agency, AlightRHS does not offer every plan available in your area.

AARP/UHC plans. Many are not specifically listed on the AlightRHS plan selector, but are available by asking your AlightRHS agent -- as indicated in list of plans available to you.

Alight agents may not understand this -- or may not know how to sell you an AARP/UHC plan.

UnitedHealthcare is the largest Medicare insurer. UHC pays royalties to AARP for use of the brandname. Although an annual AARP membership is required (bought online with a credit card) AARP plans are not group plans.

Members report that if your existing group policy is at UHC -- and you are purchasing an individual open-market policy from UHC -- you do not need to forward the letter from UHC about your disenrollment from the UHC group plan. Apparently UHC's system is smart enough to deal with that.

--cg, moderator and website maintainer

Next step: Menu of key Enrollment issues:

https://www.hpalumni.org/enroll-menu (Membership not required.)Link to this page: https://www.hpalumni.org/enroll-guaranteed-issue

Helping each other with life after Hewlett-Packard, HPInc, and HPE. Join independent HP/HPE forums

Independent, member-supported volunteer association. Not officially endorsed or supported. ©2026 Hewlett-Packard Alumni Association, Inc. By using this site you accept these terms.